Users of our Real Estate Investment Analysis program sometimes call us with questions that are not about the software but about the underlying analysis. If we had a “greatest hits” list for those questions the all-time winner would be this: “My cash flow goes up each year; the value of the property goes up each year; but when I look at the Internal Rate of Return, it goes down almost every year. What’s up with that?” To see how this can happen, let’s take a look at two very simple examples.

Example #1: We purchase a property for $100,000 all cash. It has a Net Operating Income of $10,000, so the capitalization rate is 10%. We are going to assume that 10% is the right cap rate for this market (primarily because it make the math in our example easy to follow). Because we bought the property for cash there is no debt service and so we can also assume that the cash flow is the same as the Net Operating Income. For those who require an instant (and very abbreviated) refresher course on these concepts, use the following:

Gross Income less Operating Expenses equals Net Operating Income

Net Operating Income less Debt Service equals Cash Flow

Net Operating Income divided by Capitalization Rate equals the property’s Present Value

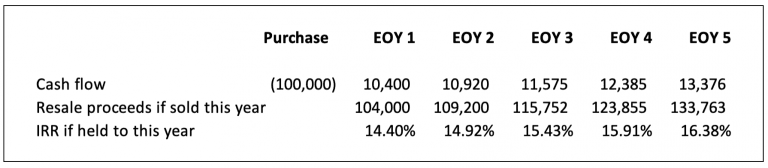

The property is in good shape and is running well when we buy it. Our initial cash flow occurs on Day One when we spend $100,000 in cash to make the purchase. We project that we can raise the rent 4% during the first year to $10,400. The property is well-located, so we believe we can get a bit more aggressive over time. We’ll project that we can increase the revenue 5% in the second year, 6% in the third, 7% in the fourth and 8% in the fifth. Here is what our projections look like:

Notice that, if we sell the property at the end of one year for its full value (i.e., with no selling costs, to keep matters simple), our Internal Rate of Return (IRR) is a pleasing 14.4%. If we sell at the end of year two, our IRR for that holding period is even better, 14.92%. If we hang on to the property for five years, we see that we can expect a 16.38% IRR. The rents go up each year, the value goes up and so does the IRR. All is right with the world.

Example #2: At the same time we buy another property, also for $100,000 cash. It too has a $10,000 NOI, but this property needs immediate management improvements to control expenses and to get rents in line with the market. We feel sure that we can get the NOI (and hence the cash flow) to $12,000 in the first year. That should get it on a stable footing, from which we expect a more modest 3% increase in rent each year thereafter. The rents go up each year, the value goes up each year, but what about the IRR?

At the end of the first year, we’re thrilled by a robust IRR of 32%. We worked hard; we deserve it. But if we hold the property for a second year the Internal Rate of Return drops to 22.76% — still not shabby but significantly lower than at the end of the prior year. Indeed, the longer we hold the property, the lower the IRR becomes. What, to coin a phrase, is wrong with this picture? Nothing is wrong, actually. The numbers are correct. Remember that Internal Rate of Return is a time-sensitive measurement. The biggest jump in cash flow and in the property’s value came early. The earlier it arrives, the less severely it gets discounted — it’s the “time value of money” concept. The increases that occur in years two through five are smaller to begin with and they get discounted over a greater number of years, shrinking their worth to us today even more.

Simply put, if we hold the property two years instead of one, then that second year dilutes the overall rate of return because it didn’t contribute as much (especially after an extra year of discounting) as the first year did. If we hold the property for three years, the return gets diluted still further.

At this point, someone in the back of the room is surely asking the insightful question, “So what?” Here’s what: The first property is telling us that it will perform better as an investment if we hold onto it for a while. Its rent increases are accelerating each year. Even though the increases have to be discounted — it’s that time value of money again — they’re growing at a pace that makes them worth waiting for. Hence the IRR gets higher with each year we hold on. The second property, however, has a bit more of a roman candle quality to its performance. The big flash comes early; after that, it just sputters along.

Does this mean you should immediately sell such a property? If you’re happy with the long-term IRR and could not find a replacement property with a greater yield, it might make sense to hold. Or you might be more comfortable following the words of immortal Janis Joplin: Get it while you can. To put that in more businesslike terms, you might decide to sell the property when the IRR peaks; then take the proceeds and reinvest them. Whichever way you go, the important thing is that you’ll be making an informed decision.

Better than being like this guy.

If you found this example helpful, I have a lot more educational material for real estate investors and developers. For example, check out these video lessons…

Real Estate Investment Case Studies where I take you step-by-step through the evaluation of five different property types: apartment, mixed-use, triple-net leased, retail strip center, and single-family property.

Mastering Multifamily Investing, where I focus on maximizing returns with multifamily property.

Or if you’re ready for a complete training series in real estate investment, development, finance, partnerships, and more, consider Mastering Real Estate Investing.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.