Life is too complicated; we have too many choices, too many options, too many channels on cable TV. It’s not surprising that sometimes we crave simple answers to complex questions.

I see that mindset very often in my interactions with real estate investors. They yearn to embrace the “50% rule” or the “2% rule” or some other shortcut that will help them cut to the chase and decide if a particular property is a good deal or not.

One metric that is relatively simple and historically very popular is the Cash-on-Cash Return (CoC). I encounter many real estate investors (more than a few of whom have a net worth significantly greater than that of this writer) who zero in on that metric like a heat-seeking missile whenever they consider buying a property. What exactly is Cash-on-Cash Return? How do you calculate it? What are its strengths and weaknesses? Is it a good metric, and perhaps more important, is it good enough?

Cash-on-Cash Return may be one of the few bits of financial terminology whose name could almost serve as its definition. You’re expecting to get a cash return on your cash invested, i.e., to earn cash on your cash. If you express the return as a percentage of the amount invested, then you have the Cash-on-Cash metric.

Let’s see this with some actual numbers. You are considering the purchase of a particular income property. For this discussion, the purchase price of the property is not the number you want to focus on. Rather, it’s the amount of your own money—the cash you actually put on the table—that you’ll be looking at. You need $100,000 to close the deal.

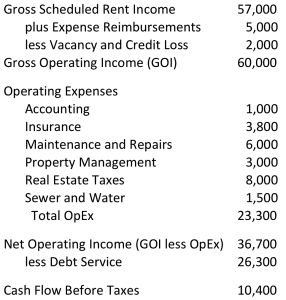

You’ve obtained information about the rental income, the operating expenses and the expense reimbursements paid by the tenants. To that information you’ve added your own allowance for vacancy and credit loss, as well as your expected annual debt service on the mortgage that you’ll need to complete the purchase. You put this all together into a cash flow statement that looks like this:

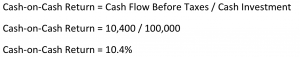

Now you do the cash-on-cash math:

So now you see your Cash-on-Cash Return is apparently 10.4%. What are you to make of this?

First, you recognize that this was a very quick and easy calculation to perform. You needed just the amount of your cash investment and some basic information about anticipated revenues and expenditures. No heavy lifting here.

Second, you observe that your cash-on-cash (and therefore your cash flow) is a positive number. That’s really important, because it means you don’t expect to reach into your own pocket to pay the bills. You have more coming in than going out.

Third, you recognize that this really quick calculation allows you to compare the first-year return on this investment to that of other short-term opportunities like CDs or T-Bills. You look at 10.4% and that strikes you as a fairly good rate of return.

In short, your initial take here is that this metric was really easy to calculate; that it told you that the property seemed likely to enjoy a positive cash flow in the first year; and that the rate of return on your cash investment appeared to be significantly better than you might get from a bank or a bond.

Are you satisfied that you can make an informed decision to buy or not to buy this property based on your calculations here? You shouldn’t be. Yes, you believe the rent and expense figures are accurate, and you did the math correctly, but are you confident that you’re seeing the complete picture? My continual mantra to my finance students is, “Look beyond the numbers, look for the story that’s behind what you see on the surface.”

It’s tempting to think that this calculation of cash-on-cash has given you an adequate perspective on how this investment will perform, but there is really a great deal more to look at and to think about here. That’s what we’ll do in the next installment.

(to be continued part 2)

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.