Lease Rollover Assumptions (LRA) is a way to store a set of parameters regarding a commercial lease rollover, parameters which can be used repeatedly when entering tenant information in REIA Pro. This feature is new to version 18 and begins with build 1.06.

Note first that this is an optional alternative to the way you have always entered tenant information in the Commercial Income worksheet. You can still manually configure a change of tenants using the “Rollover Wizard.” You will typically find our original wizard to be appropriate for a single tenant building or simple one-time tenant changes. LRA will save you lots of time if you have many tenants and/or many periodic lease changes.

Create your Assumption Sets #

First, go to the Lease Rollover Assumptions worksheet, which is found just to the right of Commercial Income.

- Click the Create button to add a blank set of assumptions which comprises 42 rows.

- Begin entering data in the first row: First name your assumptions in the LRA Category field. “Prime Retail” or “Medical Office” are examples for this field.

- Enter the term of the lease, in years.

- Rent unit of measures carries two options – click on the cell to select from the dropdown for either $/sf/year or $/sf/month.

- Enter the probability of renewal, expressed as a percentage. See the section on renewal probability below for more information.

- Lastly, enter the number of months that the space will be vacant during the rollover period, in the case where the current tenant will not be renewing.

Renewal Probability #

Enter the probability that any given tenant will renew the lease. This can be any value from 0% to 100%.

- 0% means that the current tenant will never renew and you will always have a new tenant at rollover.

- 50% means that there is an equal likelihood that a tenant will renew or leave.

- 100% means the tenant will always renew – throughout the timeframe of the analysis.

If you are not accustomed to thinking of the chance that a tenant will renew or leave, then you may find it easier to work without LRA and manually enter tenant data on the Commercial Income worksheet.

Market Rent, Abatements, Tenant Improvements and Commissions #

There are two cases to consider, depending on whether the tenant is renewing the lease or not. Enter the estimated market rent, abatements, tenant improvements and commissions for each of these cases separately.

For estimated market rent, the value for the first year is expressed in $/sf/year or $/sf/month, as selected in column J of the first row. For the second and subsequent years, a value greater than 1 is likewise treated as $/sf/year or $/sf/month. A value of 1 or less is treated as a percent increase over the previous year, e.g., 0.02 would mean a 2% increase.

Keep in mind that lease renewal is the time when the tenant can shop around, so what you enter for market rent is your estimate of the starting rent that could be found for a comparable lease elsewhere in the area. Normally, the market rent when renewing will be similar to that when not renewing.

For abatements, tenant improvements and commissions, the value for the first year is expressed in $/sf. For the second and subsequent years, a value greater than 1 is likewise treated as $/sf, while a value of 1 or less is treated as a percent increase over the previous year. Normally, any abatements, tenant improvements and commissions when renewing will be much smaller than when not renewing.

Note that values for market rent, abatements, tenant improvements and commissions only apply to the beginning of each lease period.

Rent Increases #

Below the “If Not Renewing” and “If Renewing” sections, you enter assumptions about rent increases within a given lease.

These increases are the same whether the tenant is renewing or not. In column H you may enter the increase as a fixed amount instead of a percentage; in this case, leave column F as 0.00%. The frequency of rent increases in column K must be a whole number of years; if you leave this as 0, there will be no increases.

Calculated Values #

The remainder of the block for this category shows calculated values. For each unit on the Commercial Income worksheet with this category selected, the system assumes that the following cycle will repeat, starting with the first rollover date you specify, until the end of the analysis:

- There will be some number of months of vacancy. The number of months will be a weighted average between 0 (if renewing) and the number you entered in column Q of the first row (if not renewing). The value will be rounded to the nearest whole number of months.

- A new lease will begin, with initial rate based on a weighted average of market rent. At the same time, there will be possible abatements, tenant improvements and commissions, again based on weighted averages from the two cases.

- Over the duration of the lease, the rent will increase as specified in the row labelled “Rent for each lease begins at market rent, then increases by.”

- After the number of years you entered in column G of the first row, the cycle will start over again at 1.

You can use the “Delete” button to delete a category that is no longer in use. The system will reject the request if some unit on the Commercial Income worksheet in fact still has that category selected.

Applying the LRA to your Commercial Income Tenant #

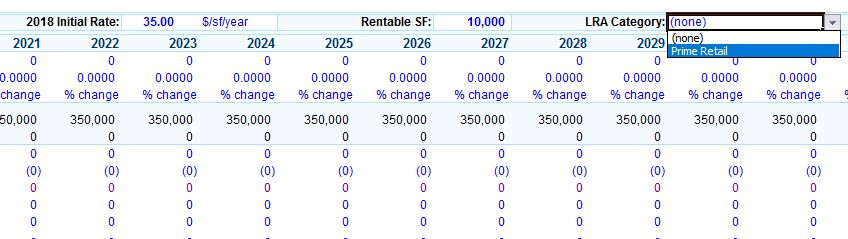

Once you have completed one or more LRA data entries, you can then go to the Commercial Income worksheet and apply these to a tenant. Select your LRA from the dropdown located in columns Q and R in the first row of your Commercial Tenant (row 11 for the first tenant)

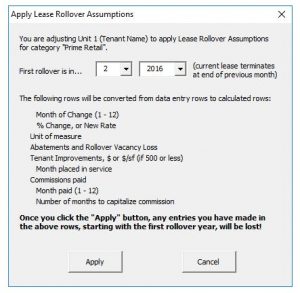

Once you make the selection a pop-up window will acknowledge your choice and warn you that you risk overwriting most assumptions for this tenant.