In Part 1 of this article, you learned what information you need to assemble to get started with the process of refinancing your commercial property — information about your property’s income, expenses and loan balance, and about the prevailing cap rate in your market. You also learned to use some of that information to estimate the current value of the property, then learned to take that result to determine if the property will likely satisfy the lender’s Loan-to-Value requirement. You got acquainted with Debt Coverage Ratio and mortgage constants and saw how to combine those to test your property’s income stream to find out if it’s strong enough to support your loan request.

Now you have some idea of what your property is worth and how likely it is to appeal to an equity partner or to satisfy a lender’s underwriting requirements. Your next task is to convey your evaluation to that potential partner or lender. You need to make your case with a professional presentation that is easy to grasp but also provides enough detail to support your evaluation of the property and your request for financing.

Unless you’re a “flipper,” you can expect to be involved with this property for the long haul, more or less. It should come as no surprise, therefore, that a lender or investor will appreciate getting a sense of how you believe this property will perform over time. You’re not going to predict the future with precision, but in most situations you should be able to make some reasonable and realistic “pro forma” projections of future performance. There is no hard-and-fast rule, but I believe your projections should go out five to ten years. With commercial properties that have long-term leases in places, 20 years would not be unthinkable.

As we develop the pro-forma presentation through the rest of this article, we’ll be using the Standard Edition of RealData’s Real Estate Investment Analysis (REIA) software. Those readers who are familiar with the software will also note that I’ve taken a few liberties with the material I display, editing some of the images (for example, removing multiple mortgages) to allow you to keep your focus on just the key elements of this example.

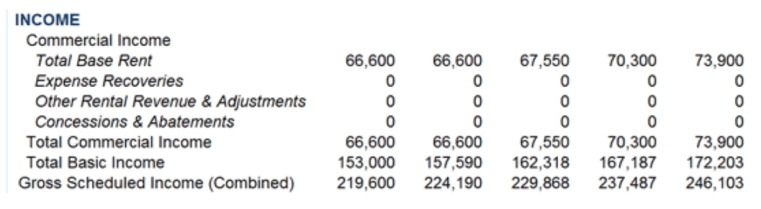

Where to start? You’re dealing with rental property, so a rent roll would be a good place to begin. And let’s assume that “today” is January 1, 2009. List your rental units (or groups of units, if you have a large number) with the current rent amount and your estimate of how those rents will change over time. You’ll recall from the APOD you constructed earlier that you expect the total gross scheduled rent for this property to be $219,600 in the first year. For the sake of making this example worthwhile, assume that the property contains both residential and non-residential units, and therefore the total amount of revenue is divided between the two types.

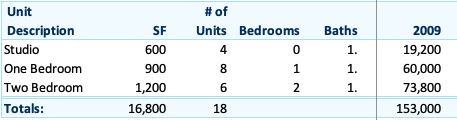

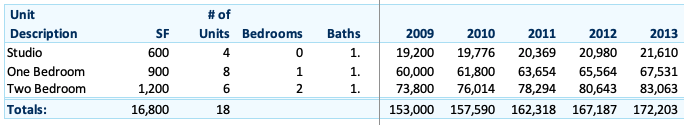

With residential units — apartments, for example — the process of building your rent roll will be fairly straightforward. The rent for each unit of this type is usually a fixed monthly amount. Residential tenancy agreements are seldom long term, most often a one-year lease or even month-to-month occupancy. It’s reasonable to assume that you will try to increase your overall rents on an annual basis. For the first year, you have the following:

Demand for your apartments has always been strong, but you decide you want to be conservative in your estimate of how much more you can charge each year so you decide to project that these rents will rise at an annual rate of 3%.

Demand for your apartments has always been strong, but you decide you want to be conservative in your estimate of how much more you can charge each year so you decide to project that these rents will rise at an annual rate of 3%.

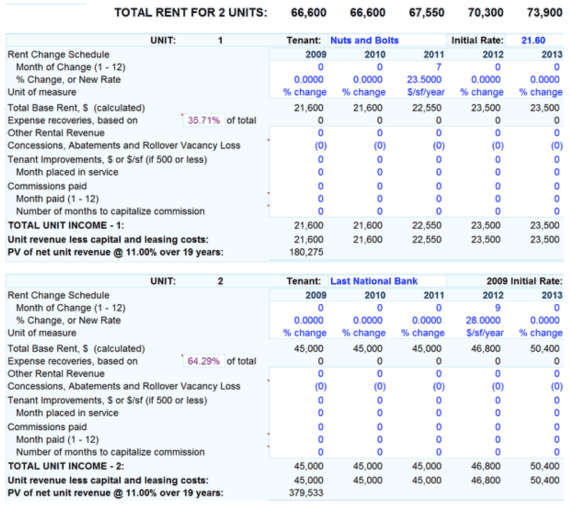

This is a mixed-use property, which means it contains commercial as well as residential rentals. At street level, below the apartments, you have two retail spaces. The first of these is a hardware store, Nuts & Bolts. This store occupies 1,000 rentable square feet and currently pays $21.60 per square foot per year. Its lease calls for a rent increase to $23.50 in July of 2011 The second tenant is Last National Bank, which occupies 2,800 square feet at $25.00 per foot. This tenant’s rent is scheduled to rise to $28.00 per square foot in September of 2012.

Note how your handling of commercial rentals differs from residential. One difference is that you typically charge rent by the square foot rather than by the unit. In most U.S. markets, the rent is expressed in terms of dollars per square foot per year, although in some it is per square foot per month. A second difference is in the length of the lease. As noted earlier, a residential tenant’s commitment may be as little as month-to-month, and generally is not more than one or two years. Commercial tenants, in order to maintain and operate a business from their space, need the certainty that they can continue to occupy for a reasonable length of time. They also need to be able to plan their future cash flow. Hence a commercial lease will usually run for at least a few years, up to as many as 20 or 30.

With the information you have in hand about these commercial leases, you should be able to project the rent from the two commercial units for next several years.

The image above is a screen shot from a data-entry portion of the REIA software. This is one image where I haven’t done any editing, i.e., I haven’t removed line items unrelated to our example. I’ve left it complete so you could see that there are other considerations you might need to take into account when you deal with a commercial lease, such as expenses passed through to tenants, leasing commissions, and improvements to the space made by the landlord on behalf of the tenant. We don’t want this article to morph into a full-scale textbook, so we’ll continue to keep our example relatively simple. However, for more information on these and similar topics, you can view our educational articles at realdata.com or refer to the software user’s guide forReal Estate Investment Analysis.

You now have a forecast of the revenue from both the residential and commercial units, and can consolidate this data to include as part of your presentation to your lender or potential partner.

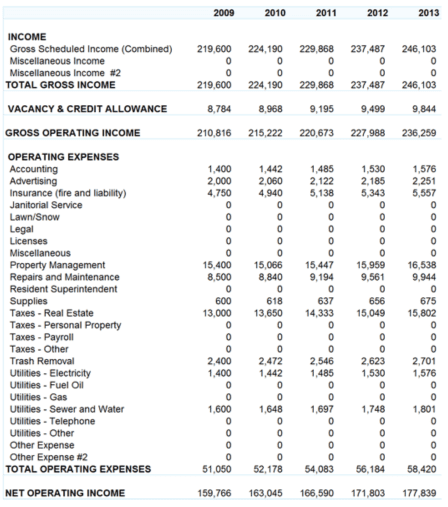

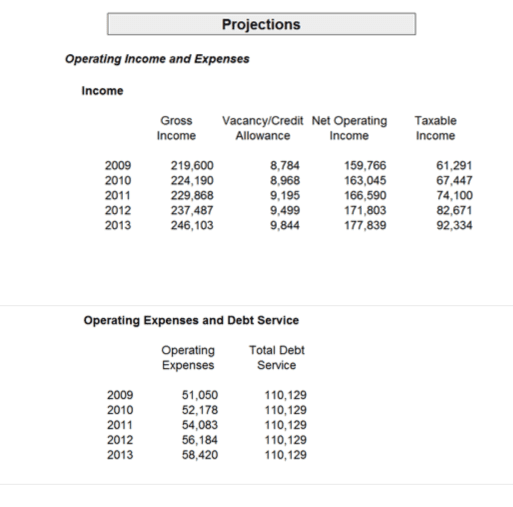

Recall that when you were estimating the value of the property you used something called an Annual Property Operating Data (APOD) form. That form displayed the total rental revenue, an allowance for vacancy and credit loss, and the likely operating expenses for the current year. To fit the needs of your extended presentation you can expand this form to as many years as you want.

For the purpose of this discussion you’ve been projecting out five years, so you’ll do the same with the APOD. You may want to refine your estimates on an almost item-by-items basis. For example, if property taxes, maintenance and insurance are among your greatest expenses, it makes sense to estimate their rates of growth individually. You probably have some history with these items that you can use for guidance. For some other expenses, such as accounting or trash removal, you may want to apply a general, inflation-based estimate. In this example, property management is one of your biggest costs. You know that it will be billed at $15,740 for the first year, but then as a percentage of collected rent — 7% in this case — for future years, so your estimate will just require that you apply the same rate. If you estimate the future rent reasonably well, then the property management fee will follow.

Let’s say you believe that property taxes will increase at 5% per year, and insurance and maintenance at 4%. For all other expenses, you project a 3% annual increase. Your extended APOD should look something like this:

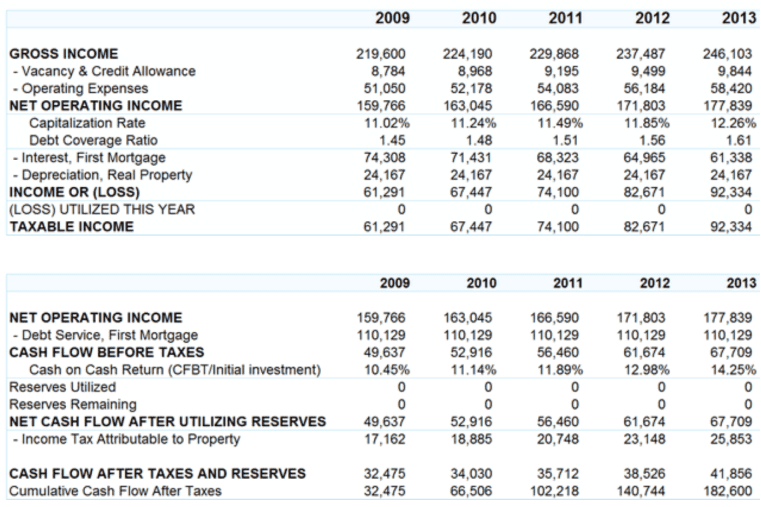

If you owned this property debt-free, your analysis would be nearly complete. But in fact, your objective here is to build an effective case for refinancing your existing loan, so you really need to demonstrate what kind of cash flow this property will throw off with a new loan in place. You need to take this at least one step further.

Recall from the first section of this article that you estimated the value of the property at $1.45 million, and that you need to refinance your $975,000 loan at 7.75% for 15 years. With that information in hand you can complete the taxable income and cash flow sections of your pro forma.

These projections should help you make a strong case for approval of your new loan. With that new loan in place, your debt coverage ratio is more than ample in the first year, and improves each year thereafter. Your cash flow is strong, and it too grows each year. It’s strong enough, in fact, that you could even survive the loss of one of your commercial tenants without plunging into a negative cash flow.

Your Net Operating Income is also going up smartly. Perhaps your lender is concerned that the current prevailing cap rate of 11% will rise to 14% by 2013, possibly reducing the value of the property dangerously close to the amount of the mortgage. Does that look like a genuine cause for anxiety?

Remember your cap rate and LTV formulas for the first part of this article.

Value = Net Operating Income / Capitalization Rate

Value in 2013 = 177,839 / 0.14

Value = 1,270,279

So, if cap rates rise to 14% and your NOI is indeed 177,839, then the property should still have a value of about 1.27 million. This is not good news for you, but does the lender have reason to lose sleep?

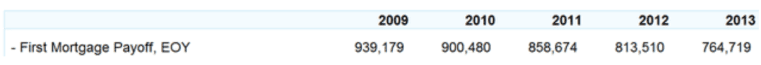

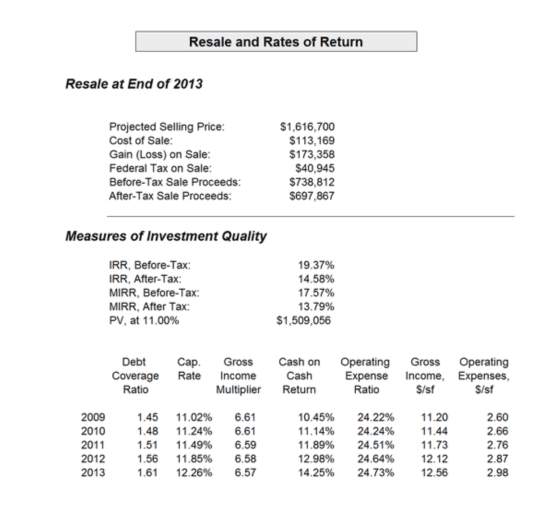

What will your loan balance be at the end of 2013? You will have been dutifully paying it down from now until five years hence, so surely you will have made a dent. If you return to the REIA software, you’ll find that it includes amortization schedules for all of your property loans. It also tracks the end-of-year balance for each loan as part of its resale analysis, so let’s look at that:

You will owe $764,719 at the end of 2013. Your property, if cap rates do rise to 14%, will be worth about $1,270,000. Recall that your lender required a Loan-to-Value Ratio of 75% when you applied for the loan. Will it be time to reach for the antacids?

Loan-to-Value Ratio = Loan Amount / Property’s Appraised Amount

Loan-to-Value Ratio at EOY 2013 = 764,719 / 1,270,000

Loan-to-Value Ratio at EOY 2013 = 60.2%

Your LTV looks even better at EOY 2013 than it did when you originally applied for the loan. It’s time to find a polite way to tell the lender to stop looking for excuses. Your loan request is solid and needs to be approved.

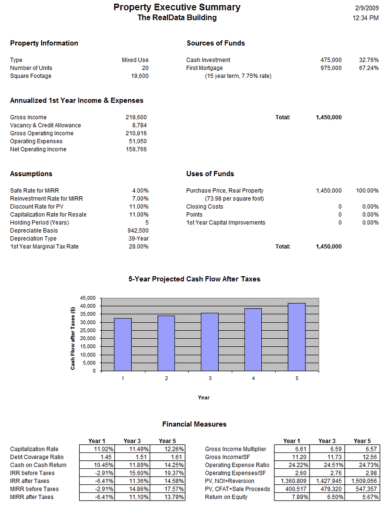

You’ve assembled a good deal of data to support your loan request, but don’t forget that a major part of your objective here is to present it in the most effective way. Start by trying to boil it all down. Simplify and summarize. Think of this part of the process as the real estate equivalent of the “elevator pitch.” Ultimately you’re going to need to provide the loan officer with every detail, but you may not get a chance to tell the whole story unless you can convey the essentials in the time it takes to ride the elevator. You need an executive summary.

This report gives a very direct one-page summary of basic information about the property and its financial metrics. Your lender can see immediately the amount of the loan you’re looking for, the LTV and Debt Coverage Ratio, the Net Operating Income and the cash flow. This report doesn’t supply the underlying supporting data to justify these numbers — that’s why it’s a summary — but taken at face value it tells the loan officer whether there is any reason to give your request a serious look.

An alternative is a report we call the “Real Estate Business Plan,” and it too looks very different from the rows and columns of numbers usually associated with a pro forma. You might assemble information into a report like this in a situation where you still want to make your initial approach with what is essentially still an overview of the property, but one that provides a bit more detail than the one-page summary. Just as with the Executive Summary, you want to provide enough information to be effective, but not so much that you discourage the recipient from actually reading the document.

We designed this report to focus on property description, sources and uses of funds, financing, cash flows, and rates of return, and to simplify its presentation by displaying only the data that is pertinent to the holding period you specify. So, even though the software can deliver projections of up to 20 years, if you want a report based on a five-year holding period, you get a nice, clean presentation with no extraneous labels or data, as you see in this excerpt:

At the beginning of our discussion of pro formas and presentations, I said that you needed to deliver a package that is easy to grasp but also provides enough detail to support your evaluation of the property and your request for financing. You may have already inferred from the progress of this article that the process of building the presentation runs in a direction that’s essentially opposite from the process of delivery. You need to begin, as we did here, at the most granular level of detail: defining individual unit rents and item-by-item operating expenses, first as they currently exist, then as you project them to grow.

That is why you built your rent roll first, then your extended APOD, then your cash flow projections. Next, you distilled this information into summary formats — the Executive Summary and the Real Estate Business Plan.

You built your case by going from the specific to the general. You’ll typically present your case for financing, however, by going the other way. You start with the Summary or Business Plan type of report, which provides enough information to introduce your request without burying the loan officer in a mountain of tiny numbers. When that loan officer says, “Where did you get these revenue projections?” you’ve got your rent roll. When she says, “How did you come up with this NOI?” you’ve got your APOD. And you can do the same for your cash flow and debt coverage, and resale value and rates of return, and more.

You’ve got it all covered.

Before we conclude this discussion, a brief reality check is in order. The example we just worked through was a happy case study because the property’s income stream justified the financing you sought. All the number crunching in the world, however, won’t transform a troubled investment into a good one. A detailed analysis can, however, still be helpful because it can show you what level of revenue you need to reach, or what level of cost-cutting you have to achieve to bring the property into positive cash flow territory and get it back on its feet. But whatever you do, don’t try to “enhance” the numbers to make the property look good. You’re not going to fool the lender and there’s not much point in fooling yourself.

So, what did you learn in Part 2 of this article? You learned to build a rent roll, one style for residential units and another for commercial. You learned to develop pro forma projections by extending your current-year estimates of revenue, operating expenses, and cash flows into the future. Perhaps most important, you learned about creating presentations out of those pro forma projections — presentations that are readable and effective, and that can help you make you case for financing your investment property.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.