We frequently hear a question that goes something like this: “I’m considering the purchase of an income property where the seller will take back a second mortgage for the entire down payment. Why can’t your software figure out the rate of return on a zero-cash-down investment?”

You’ve surely heard the excuse, “It’s not the software’s fault” more times than you care to recall. This time, however, the blame really does not fall upon the software, the hardware, the astronauts, Bill Gates, el niño or any of the other usual suspects.

The problem lies in the question itself: “What is the rate of return on a zero-cash-down investment?” Let’s try posing this query a few other ways:

“What’s my return on investment when I make no investment?”

“What’s my rate of return on nothing down?”

“What’s my rate of return on nothing?”

You can see where we’re going with this. You cannot calculate the return because there is no such thing as a zero-cash-down investment. If you invest nothing, then you have no investment. You might just as well ask, “What is the height of an adult unicorn?” because you would get the same answer. No such animal.

This is not just clever semantic swordplay. Fundamental to the concept of investment is that you put your own capital at risk. (For the alert reader, capital could take a form other than cash. I once witnessed a deal where the buyer signed over a sports car as his down payment. For the sake of simplicity, we’ll just refer to the buyer’s investment as cash, with or without wire wheels.)

No-money-down violates the letter, the spirit and the algebra of conventional investment. Return on investment, by its simplest definition, is the amount of the return divided by the amount of the investment. Anything divided by zero is infinity. Hence, even a one-cent return on a zero-dollar investment would be an infinite rate of return.

In short, if you as the buyer put no cash into the deal, you have made no investment and hence you cannot calculate a rate of return. Even if the acquisition of an income property with no outlay of cash should not be called an investment, such deals do happen and can even succeed (although perhaps not as effortlessly as in the mountain of books and tapes showing how you too can amass great wealth with no cash).

If you cannot measure the potential success of a no-money-down deal using rate of return, is it time to put away your computer, trust your instincts and not bother with any kind of financial analysis? Quite the contrary. Even if you can’t measure the rate of return, you can still perform some essential analysis. In fact, caution may demand that a “non-investment” such as this, with little margin for error, be scrutinized with even greater than usual care.

In particular, there are two important issues that require careful examination: Cash flow and resale. If you are going to try to finance 100% of a property’s purchase price, you are obviously going to have to service more debt than you would if you had put some meaningful amount down. Can the property’s income cover all of its operating expenses as well as these debt payments? If not, then you’ll have to reach into your own pocket to make up the difference (so much for the “no cash, no problem” scenario).

Here is where you have to take a very hard look at the numbers. The burden of debt payments on a property with 100% financing leaves you very little wiggle room. Are the income figures realistic? Are you relying on immediate rent increases to cover your costs, increases that could initially result in vacancies rather than additional revenue? Are your expense projections based on verifiable sources and do you have the resources to handle unwelcome surprises?

A second key issue is the property’s potential resale value. (If you haven’t done so already, you should read our previous articles on “Understanding Net Operating Income” and “Understanding Real Estate Resale” and even take our e-course or read my books to help you understand the relationship between income and value.) Since your financing is likely to eat up most of your cash flow, the eventual resale of the property is where you will typically have the greatest chance of making money. Once again, realism is of paramount importance. Why might a new buyer give you more than you paid? Can you make physical improvements and management improvements that will make this property attractive and more valuable to an investor?

To recycle an old saying, if no-money-down deals were easy, everyone would do them. Even though you can’t calculate a conventional rate-of-return, be sure that you do the rest of your homework — cash flow projections and estimated resale — before you take the plunge.

The math surrounding vacancy and credit loss allowance is certainly simple enough. You start with your top line – Gross Scheduled Income – which represents a perfect-world situation where all units in your property are rented and all your tenants pay on time with good checks. From that you subtract an allowance to account for the warts of an imperfect world, in this case the potential rent that may be lost to vacancy and the revenue lost due to the failure of tenants to pay. Typically you will estimate the allowance as a percentage of the Gross Scheduled Income.

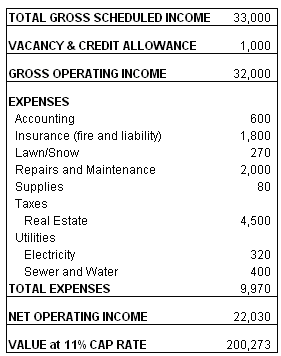

The result is called the Gross Operating Income (also known as Effective Gross Income). From that subtract the property’s operating expenses and the result is the Net Operating Income, the number you will capitalize in order to estimate the property’s value. An example should make this easy to see:

In this example you’ve assumed that about 3% of your potential income will be lost to vacancy and credit. As you examine this table, you’ll recognize that the greater the vacancy and credit loss, the lower the NOI and hence the lower the value of the property. There’s a lesson here, of course. The vacancy and credit loss projections you make, for the current year and for the future, are going to have a direct impact on your estimate of the property’s value. If you’re careless about these projections you risk skewing that estimate of value.

Vacancy Loss

Behind the numbers are some truisms that you want to keep in mind. The first, of course, is that vacancy and credit loss are generally unwelcome. Loss is loss. However, experienced investors will usually not fall on their swords at the first sign of an empty unit. Conventional wisdom among veterans is, “If you never experience a vacancy, your rents are too low.” I’ve never seen anyone break out the champagne upon learning of a vacancy, but there is some merit in this seemingly self-delusional chestnut. One certain way to find the top of the market is to push past it. When you reach a rate where you no longer can find tenants in a reasonable amount of time, you can pull back. The vacancy you experience will cost you something, but you’ll be sustained by your expectation that the loss will be offset by the higher revenue you can earn by maximizing your rent.

Another reality to keep in mind is that not all vacancy allowances are created equal. In general, commercial space takes longer to rent than does residential and larger spaces take longer to rent than smaller. If you have a large retail space whose lease is coming up for renewal, it might not be unreasonable to allot six months or more of rent as a potential vacancy loss. At the other extreme, a properly priced studio apartment should rent quickly in most markets, so a minimal allowance would suffice.

When making projections about future vacancy, start by looking backward. How quickly has new space been absorbed in the past? Then look forward and consider what might change. What is the likelihood of new, competing space being built? Are there reasons to expect demand to rise or fall – reasons such as new employers moving in or established businesses moving out?

Remember that your objective is to forecast as accurately as possible how this property will perform for you in the future. You can and should look at best-case, worst-case and most-likely scenarios for vacancy just as you would for income and expenses, and don’t try to convince yourself that only the best case is real.

Credit Loss

Avoiding credit loss is a problem you get one shot at solving, and that shot occurs before you sign the lease. Would you sell me your used car in exchange for an I.O.U. or a personal check? You would expect cash or a bank draft. Why would you turn over an even more valuable asset, your rental property, without similar caution? That caution, at minimum, takes the form of a credit check and some good faith money up front in the form of security deposit and advance rent.

There are numerous companies online with whom you can establish an account for checking an applicant’s credit history. Any reputable source of credit reports will expect you to provide proof of your identity and to present written authorization from the prospective tenant to obtain the report. The simplest way to accomplish the latter is to include that authorization as part of the signed rental application. A landlord association often can help you gain access to a reliable source of credit reporting.

Credit losses are a part of doing business and you’re not likely to succeed in eliminating them completely. Your best single defense against is to establish minimum acceptable credit standards and then resist the temptation to trust your instincts and make exceptions. Everyone has a dog-ate-my-homework explanation for poor credit history. Some of the stories are probably true. Nonetheless, the single best predictor of a collection problem is past history. If he didn’t pay his cell phone bill, he probably won’t pay you either.

Some investor’s simply ignore vacancy and credit loss when making their cash flow projections. You might want to call that the emperor’s-new-clothes approach, where you see what you want to see and pretend you don’t notice what’s missing. That’s not much of an investment strategy and it won’t work for very long – reality has a habit of happening whether you plan for it or not. The more prudent investor will do his or her best to minimize these losses, but at the same time work with projections that are realistic.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.