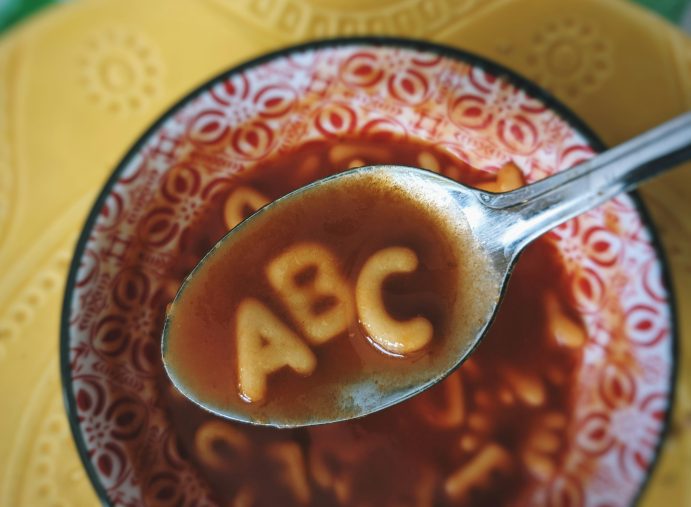

Stirring the Alphabet Soup of Real Estate Investing

The acronyms you encounter on your journey to building wealth in real estate may seem like a witch’s brew of random letters. But every business or profession has its secret handshakes, its unique vocabulary, and real estate is no different.

This specialized language is peppered with jargon and acronyms, but it can serve as a useful shorthand among colleagues. While it may seem intimidating at first to newbies, mastering this lingo and using these terms correctly not only facilitates communication but also demonstrates expertise and insider knowledge.

I’ll begin with “part one” of my discussion by decoding a list of what I believe are 35 of the most important real estate investing acronyms that you should recognize. Some may already be familiar, but stay tuned because, in follow-up posts, I’ll elaborate on the meaning of some that are particularly vital to your success as an investor.

Let’s look at our list:

| 1031 | Sec. 1031 Tax Deferred Exchange |

| ARV | After-Repair Value |

| BRRRR | Buy, Rehab, Rent, Refinance, Repeat |

| CAP | Capitalization (Rate) |

| CapEx | Capital Expenditures |

| CCIM | Certified Commercial Investment Member |

| CFAT | Cash Flow After Taxes |

| CFBT | Cash Flow Before Taxes |

| CMA | Comparative Market Analysis |

| CoC | Cash-on-Cash Return |

| COMP | Comparable Property |

| CRE | Commercial Real Estate |

| DCF | Discounted Cash Flow |

| DSCR | Debt Service Coverage Ratio |

| FMV | Fair Market Value |

| FSBO | For Sale by Owner |

| GOI | Gross Operating Income |

| GP | General Partner |

| GRI | Gross Rental Income |

| GRM | Gross Rent Multiplier |

| IRR | Internal Rate of Return |

| LLC | Limited Liability Company |

| LP | Limited Partner |

| LTV | Loan-to-Value |

| MAI | Member, Appraisal Institute |

| MIRR | Modified Internal Rate of Return |

| NNN | Triple Net Lease |

| NOI | Net Operating Income |

| NPV | Net Present Value |

| OpEx | Operating Expenses |

| PITI | Principal Interest Taxes and Insurance |

| PV | Present Value |

| REIT | Real Estate Investment Trust |

| ROI | Return on Investment |

| SFH | Single-Family Home |

The meaning of some of these terms may be self-evident, but others invite explanation. Join me for part two of this discussion, where I’ll take a deeper dive into some key terminology.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.