Internal Rate of Return (IRR) is a core metric for evaluating the profitability of income property investments. It is perhaps the one metric that accounts for the interplay between the magnitude and the timing of future cash flows.

From my experience, investors agree that a high rate of return is better than a low rate, but some are less clear about exactly what IRR is and how it’s calculated. So let’s start with some basics—and then dig deeper into levered and unlevered IRR.

Category: Education

I’ve just re-launched an updated version of my e-book, “10 Commandments for Real Estate Investors,” and you now can get it free on Amazon Kindle & Apple Books!

Real estate investing can be an excellent way to build wealth or to provide a cushion for your retirement; but it can also be a snare for those who lack preparation, planning, and realistic expectations.

In this brief series of essays, I guide you through some investment principles you can live by.

If you’re going to be serious about real estate investing, it’s imperative that you understand the numbers behind your deals.

That’s why I’ve always stressed my mantra, “First do the math, then do the deal.” I’m glad to help you simplify that task with my books, my online video courses, and my Excel-based software.

But maybe you’d like to just put a toe in the water first.

Leverage is a fundamental tool in real estate investing, allowing investors to acquire properties while using their own cash for just a fraction of the total cost. Borrowing money to invest in income-producing properties can amplify your returns, allowing you to scale faster than relying solely on your own capital. However, excessive leverage can prove to be a double-edged sword—when the market is in your favor, it opens the door to greater opportunity. But if the market turns against you, it can lift the lid on Pandora’s box. In this article, I’ll explore the benefits and some of hidden dangers of high leverage, how it can impact long-term investment success, and ways to strike the right balance.

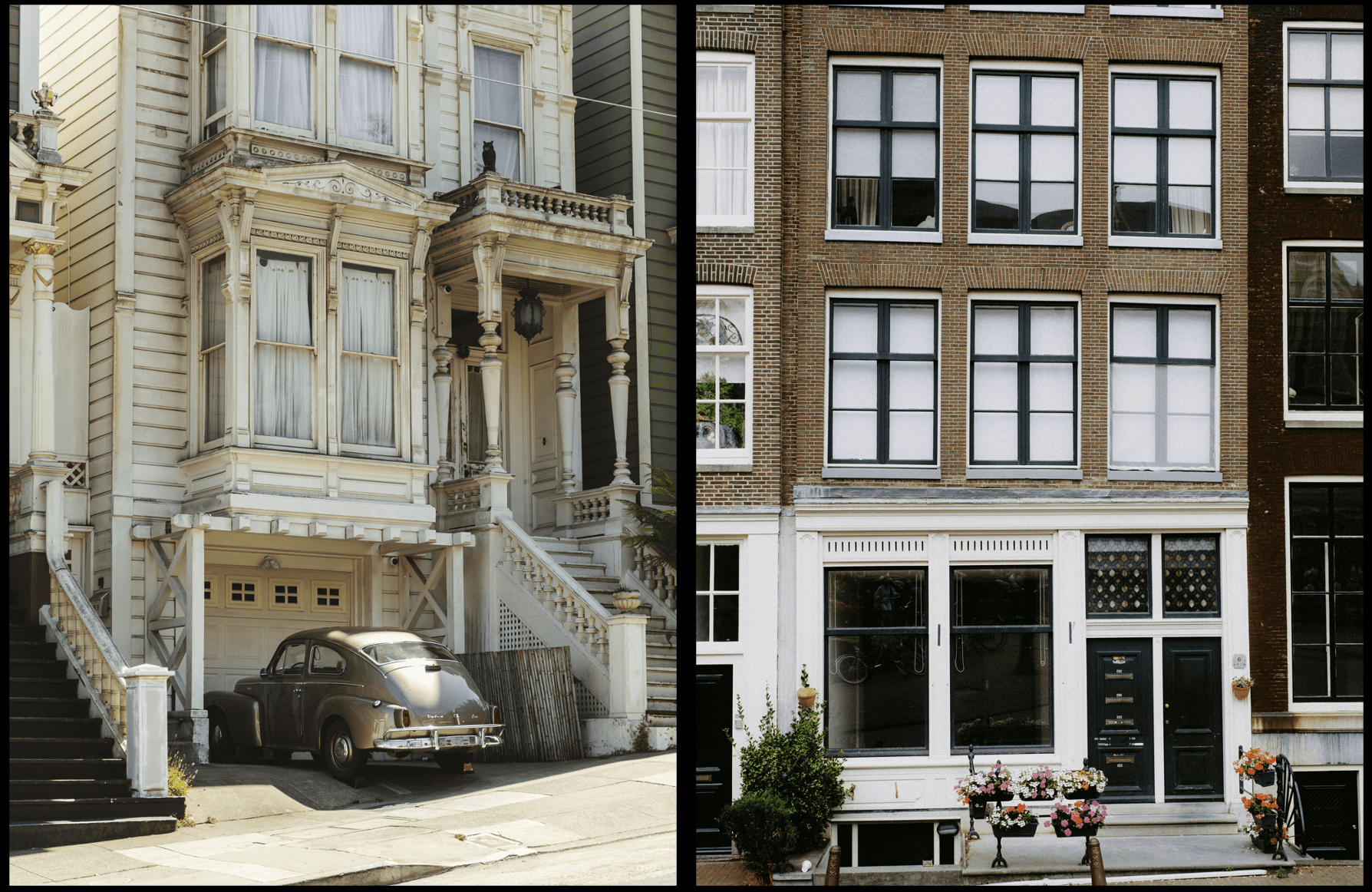

When you’re getting into real estate investing, especially if you’re starting out, there’s one big question to tackle early on: Should you go for value-add or turnkey properties? Both strategies have their pros and cons, their benefits and challenges, and this guide will help you figure out which is the better fit for your goals, budget, and experience.

I have several ebooks that I send out at no cost to folks who sign up for our “insights” mailing list. But in today’s hyperspeed world, I’m finding that now a lot of people who are constantly on the go just don’t have time to sit and read as much as they’d like. That’s why, with help of my AI sidekick, I’ve started turning the content of those ebooks into podcasts.

Follow this link to listen to the first. And stayed tuned for several more.

https://www.realdata.com/realestateeducation/5_Key_Steps_podcast.mp3

In my previous post, I gave you a list of some of the most common acronyms used in real estate. Not a complete list, of course, but a good start to decode the secret jargon of our industry.

And as I professed then, mastering this lingo and using these terms correctly not only facilitates communication but also demonstrates expertise and insider knowledge.

Now that we have a representative list, let’s look at the meaning of some of these terms.

The acronyms you encounter on your journey to building wealth in real estate may seem like a witch’s brew of random letters. But every business or profession has its secret handshakes, its unique vocabulary, and real estate is no different.

In my previous post, I discussed what I believe are some of the most important pros and cons of investing in self-storage real estate.

As with most real estate sectors, self-storage features some terms that are particular to this property type — specifically in how owners describe occupancy: Unit Occupancy, Physical Occupancy, and Economic Occupancy. Let’s review them:

If you’ve gotten involved as a landlord or tenant with non-residential real estate, such as retail or office buildings, then you have probably encountered a phenomenon that may go by any of several names: expense recoveries, expense reimbursements, pass-throughs, or common area maintenance (CAM) charges. What exactly is this phenomenon and how does it work?