Life is too complicated; we have too many choices, too many options, too many channels on cable TV. It’s not surprising that sometimes we crave simple answers to complex questions.

Category: Real Estate Analysis

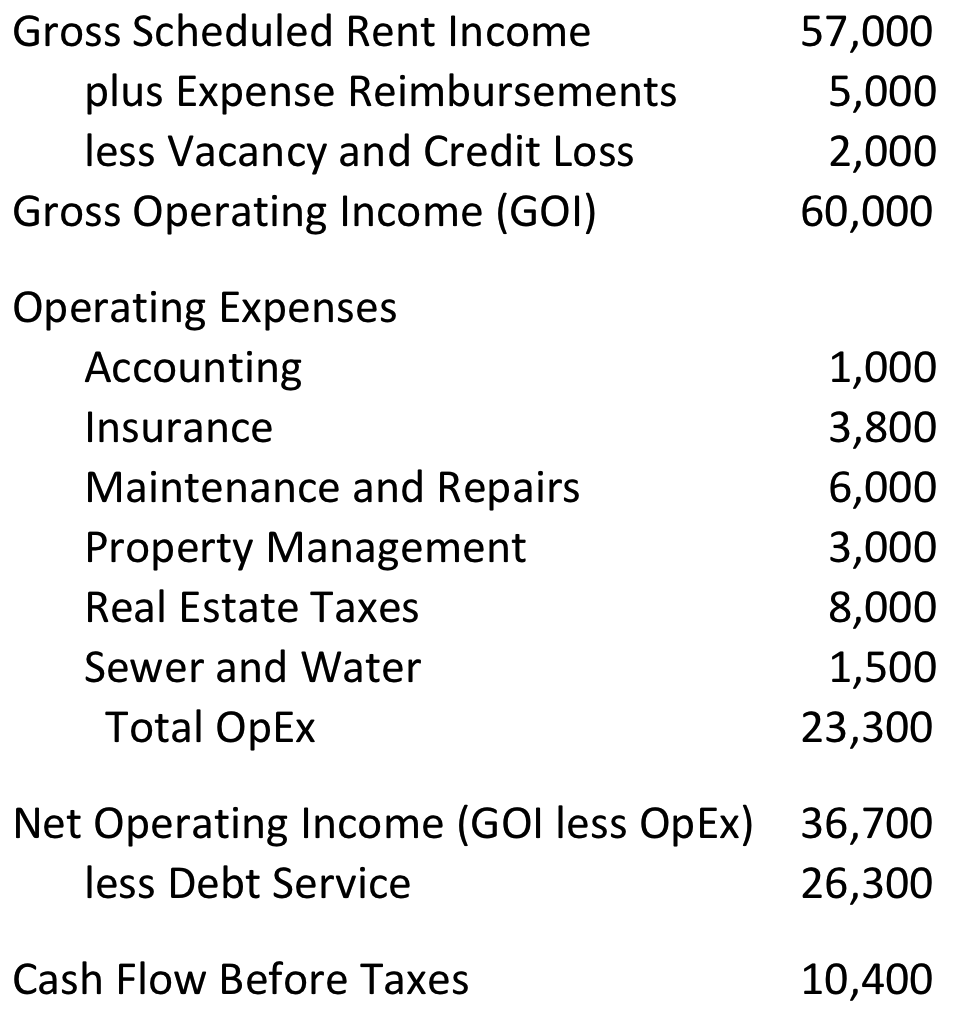

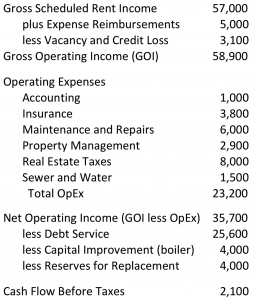

In the first part of our discussion, you looked at the simple math that underlies Cash-on-Cash Return. The short version goes like this: First you calculate your property’s first-year cash flow before taxes—essentially all the cash that comes in from operating the property minus all the cash that goes out. Then you divide that by your initial cash investment, and that percentage is your Cash-on-Cash Return. Nothing could be simpler.

A while back, I posted a two-part series called “The Cash-on-Cash Conundrum.” In the first installment I explained the calculation and underlying logic of CoC, and in the second I discussed some of the pitfalls of overreliance on this particular measure.