Situation: You are evaluating a property to purchase where you will be assuming a loan where payments have already been made on the loan for some time.

You can easily enter such a loan in REIA Express or in REIA Pro. In Pro, this applies to both the Quick Analysis and Detailed Long-Term Analysis.

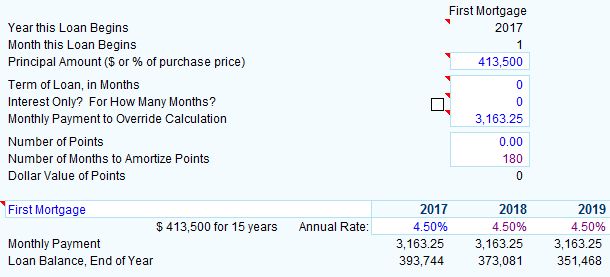

Enter these values into the program:

- the current principal balance of the mortgage you are assuming;

- the interest rate being charged, and;

- your actual monthly payment (in the “override” cell)

The program will make all of the correct calculations for that assumed loan. The program will calculate the adjusted term, which is the number of remaining months needed to retire the loan with the specified monthly payment.

Example #

You assume a loan which was originally $500,000 in its 60th month. The interest rate is 4.5%, the loan payment is $3,163.25 and the current balance is $413,499.73. The loan was originally 200 months. The data entry for this loan, in REIA Pro, is as shown:

You may not know the original amount of the mortgage. That is OK. Note that REIA does not require that you enter this value.

Note that the software automatically enters the number of months to amortize points, which is 180. We do not need to enter the remaining term since the software calculates this, here at 180 months or 15 years as shown.

Advanced Features #

For even greater control, you may enter a separate monthly payment override for each year. See Advanced Features for more information.

The Advanced Features worksheet is located all the way over on the right of your list of tabs. It is probably easiest accessed via the RealData menu > Worksheets > Advanced Features.