REIA Professional Edition v17 offers quite a few financing options. This article discusses some of the most common.

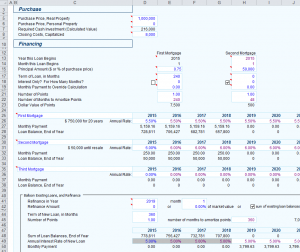

Suppose you plan to purchase a property for $1,000,000. Your first mortgage will finance 75% of the purchase price for 20 years at 5.5% interest. You will also have an interest-only second mortgage of $50,000 at 6.0% interest. Then in year 5 you will refinance, replacing both mortgages with a single 30-year loan at 5.0% interest. Each of these three loans will cost 1 point. Below is a screenshot from the Cash Flow & Resale Assumptions worksheet reflecting all this.

Row 15 is labelled “Principal Amount ($ or % of purchase price)”. For each of the three mortgages, a value greater than 1 is treated as a dollar amount. For example, the value 50,000 in cell H15 means the the second mortgage is for $50,000. A value less than or equal to 1 is treated as a percentage of the purchase price. For example, the value 0.75 in cell E15 means the first mortgage is for 75% of the purchase price, or $750,000.

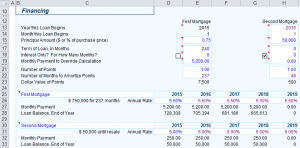

What would happen if you increased the monthly payment a bit on the first mortgage? Right now, row 27 shows that you’ll be paying $5,159.16 per month. What if you decided to rounded this up to $5,200.00? You can model this by entering 5,200.00 in cell E19, labelled “Monthly Payment to Override Calculation.”

You can see in row 28, “Loan Balance, End of Year,” that the balance on the first mortgage at the end of year 4 is $655,613, compared to $657,800 without the override. In fact, the effect of the override is similar to the term being 236.597 months instead of 240 months.

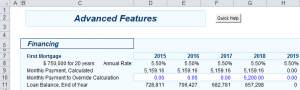

What if you wanted to pay $5,200.00 per month only in year 4, keeping the regular monthly payment of $5,159.16 in years 1 to 3? To model this, set cell E19 back to 0.00, and go to the “Advanced Features” tab. Enter 5,200.00 in cell G10 of Advanced Features.

Now in row 11 of Advanced Features, you can see that the balance on the first mortgage at the end of year 4 is $657,298.

For more information about financing options in REIA Professional Edition, see Chapter 7 of the User Guide.