-

Frank Gallinelli

Let’s Talk About Your Options

When you’re getting into real estate investing, especially if you’re starting out, there’s one big question to tackle early on: Should you go for value-add or turnkey properties? Both strategies have their pros and cons, their benefits and challenges, and this guide will help you figure out which is the better fit for your goals, budget, and experience.

Value-Add Properties

Value-add properties are all about potential. These are places that need some love (and cash) to really shine. Here is where you’ll look for the opportunities to make significant improvements to reach the property’s full potential. Things you might do:

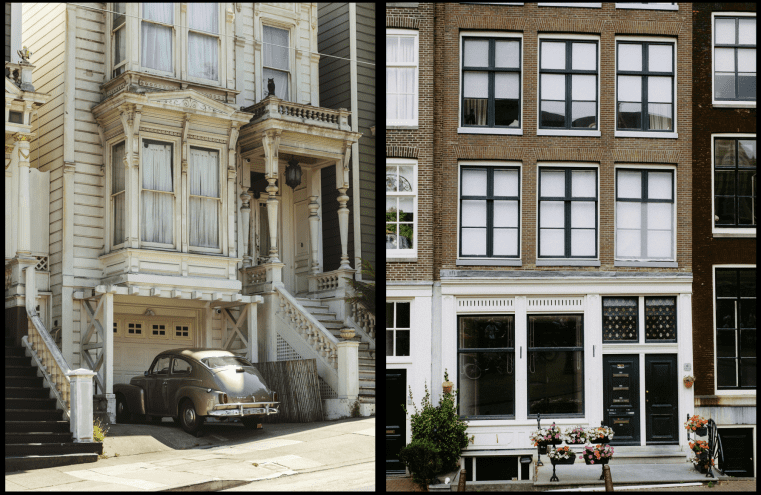

- Fix It Up: Remodel kitchens, upgrade bathrooms, or improve curb appeal. A handsome exterior makes a good first impression and conveys that the owner cares about the property.

- Raise the Rents: Sometimes rents are below market—your upgrades can justify charging more.

- Go Green: Install energy-efficient heating and hot-water systems, or even solar panels if feasible.

- Boost Security: Add smart locks, better lighting for parking and common areas, and security cameras. Security is a vital amenity that can attract tenants.

Turnkey Properties

Turnkey properties are ready for tenants to move in and should be generating income for you as soon as you close the deal. Features typically include:

- Market-rate rents: Do your homework and know what other property owners are getting for similar properties in the same or similar locations.

- Recent renovations or excellent maintenance: Inspect the property carefully and also ask to see any maintenance records.

- Existing tenant base providing stable revenue stream: Ask to see leases and, if possible, payment histories to confirm.

- Professional property management already in place: Check the terms of management agreements.

So, Which One’s Your Style?

What Do You Need to Bring to the Table?

Value-Add Properties

- Money: Typically command a lower purchase price but require a higher renovation budget. You’ll need a cushion (aka contingency fund) for unexpected expenses.

- Time: Renovations mean you’ll spend a good amount of time dealing with contractors, permits, and the overall management of the project. And you’ll need to devote time to getting it fully rented once the hammers and saws are put away.

- Skills: You’ll need to know your way around construction, have a first-hand familiarity with the local market for rental property, and be good at managing people. And you definitely need to know how to project current and potential future cash flows and how they affect value. RealData’s REIA software can be a big help with that.

Turnkey Properties

- Money: You’ll likely pay market value for the property, but financing should be straightforward. Plus, the cash flow starts immediately.

- Time: With a tenant base already in place at market rates and the property in good physical condition, your management time should not be onerous — just keep an eye on performance and your ear to the ground to be aware of shifts in the rental market

- Skills: It’s essential that you understand how to estimate current market value and potential future value, as well as the key investment metrics that will inform your buying and selling decisions. Our comprehensive video course will teach you what you need to know, and again our REIA software will do the heavy lifting (i.e., calculations) for you.

Risk Factors

Value-Add Risks

- Renovation surprises: Costs you didn’t plan on, delays, permits, materials availability

- Market changes: The market could shift while your improvements are in progress. Changes in the local economy, especially in employment, can impact your plans, as can natural disasters. You could experience a period of vacancy at startup that you didn’t, and couldn’t, anticipate.

- Financing challenges: Interest-rate changes or unexpected requirements from your lender can alter your expected returns.

Turnkey Risks

- Hidden maintenance issues: Don’t skimp on your due diligence.

- Buying at market peak: Think about your investment horizon. If you’re in for the short term, as is common with value-add, be wary of buying when prices have been rising over an extended time.

- Dependence on property management: A good property manager can be a great benefit, but monitor their performance carefully, especially at the start to be sure they’re working in your best interests.

Potential Returns

Value-Add Returns

- Equity Growth: Improvements drive NOI growth and therefore they increase value.

- Cash Flow: Expect a boost once renovations are done.

Turnkey Returns

- Equity Growth: Predictable growth and steady loan paydown.

- Cash Flow: Immediate and stable, but less room for big jumps.

How to Decide

Consider Value-Add If:

- You’ve got some experience with real estate in general and construction in particular.

- You can handle irregular cash flow from the property during renovations.

- You’re looking for higher returns and don’t mind rolling up your sleeves.

Consider Turnkey If:

- You’re new to investing or can’t devote a lot of time to overseeing your property.

- You want reliable cash flow from day one.

- You’re aiming for a more hands-off investment.

- Your investing timeline is long-term, and you’re willing and able to buy and hold.

Your Game Plan

For Value-Add Properties:

- Do Your Homework: Learn the market, build a network of contractors, and understand renovation costs.

- Analyze Deals: Can we possibly say this enough? RealData’s software has always been laser-focused on analyzing deals. Understand how well your potential investment might perform before you start writing checks. And learn how to evaluate the results of your analysis.

- Execute Like a Pro: Stick to your budget and timeline, and keep the end goal in mind.

For Turnkey Properties:

- Research Markets: Look for stable areas with strong rental demand.

- Vet the Property: Review financials, the rental market, and the property’s condition.

- Stay on Top of Things: Monitor performance in the short term while you plan for the long term.

Final Thoughts

Both strategies can be profitable—it all depends on what you want out of your investments. Are you more interested in short-term, potentially bigger gain; or longer-term, more modest but stable returns. There’s no right answer. It’s all about your goals.

Start small if you’re new, and don’t hesitate to mix and match strategies to balance risk and reward.

Whatever path you choose, make sure it aligns with your vision for financial freedom.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.