I had a question recently about a metric called Yield on Cost, aka Return on Cost and also sometimes called Development Yield. So what is it and when and how might it be useful?

Yield on Cost is very similar to cap rate, which you’re already familiar with, especially if you’ve followed my posts, read my books or taken my online course. It’s a metric commonly used by investors and commercial appraisers, and it’s the ratio of a property’s Net Operating Income to its market value. It looks at an income property at a point in time.

What’s the difference between cap rate and Yield on Cost?

Cap rate measures income in relation to the value of a property. Yield on cost measures income in relation to the total cost of the property.

Another way to think of Yield on Cost is as a forward looking cap rate.

Let’s try to make some sense of this by hanging some numbers on these words.

You decide you’re going to buy a property today with its 50,000 NOI at the market cap of 5% for $1 million. But you see a value-add opportunity here to make improvements and to create value. You’re going to spend money to make money.

Specifically, you’re going to upgrade these apartments and raise the rents. Remember value-add is an opportunistic approach to investing. You’re looking for a better return, and almost by definition, higher return implies greater risk. So you want to try to get a quick read on whether that higher return – in your judgment – is going to be worth the greater risk.

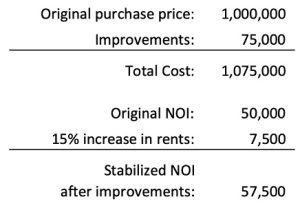

You’re thinking of spending $75,000 on improvements so you can bump up rents by 15%. Let’s see how that looks:

Now you have a new total cost for the property of $1,075,000 – the purchase price plus the improvements — and a NOI that’s 15% higher than before, or $57,500. Let’s use the Yield on Cost formula, which is basically a lot like the cap rate formula:

YOC = stabilized NOI / total cost

YOC = 57,500 / 1,075,000 = 5.35%

I believe you’ll see right away how this is just slightly different from the standard cap rate formula. With YOC you’re using the NOI as it is stabilized after you make your improvements; and you’re using total amount the property cost you rather than what you think it might be worth. Again cost, not value. So now…

Yield on Cost = 57,500 / 1,075,000 or 5.35%

Your yield on cost is higher than the 5% market cap rate, and that’s what you want. You want a so-called spread between the Return on Cost and the market cap rate for your value add scenario. That spread is 0.35%.

The question that only you can answer is, is that spread worth the risk?

One way that might help you decide is to ask: What do you think the property is going to be worth after these improvements? For that you cycle back to the cap rate formula, because that deals with value as function of income. You’ll use the market cap of 5% with your new stabilized NOI

Value = NOI / cap rate

Value = 57,500 / .05

Value = 1,150,000

Its value now, after these improvements, is $1,150,000, which is $75,000 more than your total cost:

Value (1,150,000) minus cost (1,000,000 + 75,000) = 75,000

The math here is probably simpler than the decision itself. That decision rests on your subjective evaluation of the risk involved. How confident are you that you can raise the rents by 15% after spending $75,000 on improvements? In other words — You’ve calculated the potential reward, objectively. Now you must weigh that against the risks, — risks which you measure pretty much subjectively.

So to wrap things up… Yield on Cost is similar to cap rate except it uses stabilized net operating income after improvements and measures that against total property cost. It does that rather than weighing current NOI against current property value — which is what you’re doing with regular cap rate. Yield on Cost is extremely easy to calculate and it can be useful with value-add investments to get a sense for how improvements to a property will impact your return. It should also give you a sense as to whether the additional return is worth the risk.

Yield on Cost is often used by developers for a quick read on a potential project. Look for more about this metric in a new lesson I will be adding to my course, Introduction to Real Estate Investment Analysis.

In the meantime, if you’d like to watch my discussion of this topic in a video post, you can get that here: https://vimeo.com/635351764

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.